So as you can see, at $48,000 per year as a single person, paying something like $1,300 for a high-priced home or rental is going to be tough. Remember to keep reading to the bottom for the 50-30-20 rule spreadsheet! 50% – needs on a $48,000 annual salary

So her 50-30-20 budget starts with $3,000 per month Based on current tax laws at the time of article publication, I’m estimating her employer deduction for taxes, Medicare and social security at 25%. Photo credit: Nikki’s 50/30/20 budget – example with a $48,000 incomeįor the first example, I’m going to review a single woman making $48,000 per year. Next, let’s take a look at 2 example budgets to see how the 50/30/20 rule works. Remember this budget strategy is meant to be simple so don’t overcomplicate it! If you have health insurance or retirement is taken out automatically, add that back in to include those costs in your 50/30/20 categories. So exclude federal requirements that your employer takes from your paycheck: state and federal income tax, Medicare and social security. You’ll use your after-tax income to start your calculations.

#MONTHLY FAMILY CASHFLOW SPREADSHEET HOW TO#

How to start calculating a 50-30-20 budget Ready to level up your savings game? Financial coaching might be right for you! Learn more here. Saving for a specific item like a new car or vacation.The savings category includes savings and debt repayment (although many times your debt is a ‘want’ so it should go there!) Non-essential vehicle purchases/upgrades.Wants – 30%Īlso known as lifestyle choices, this category includes the ‘extras’ in life or certain lifestyle choices you’ve made that make you happy. Real quick – are you here because you’re stressed, overwhelmed and motivated to change your financial situation? Working with a financial coach can help you crush your money goals fast! Find out more here. Car and insurance (we’ll get to car payments later).This budgeting category includes anything you need to live, work and survive this crazy life. Your income goes to needs, 30% to wants and 20% to savings.

#MONTHLY FAMILY CASHFLOW SPREADSHEET DOWNLOAD#

Make sure to read to the bottom of the article to download the free 50 30 20 rule spreadsheet! Here’s how to use the 50 30 20 budgeting rule

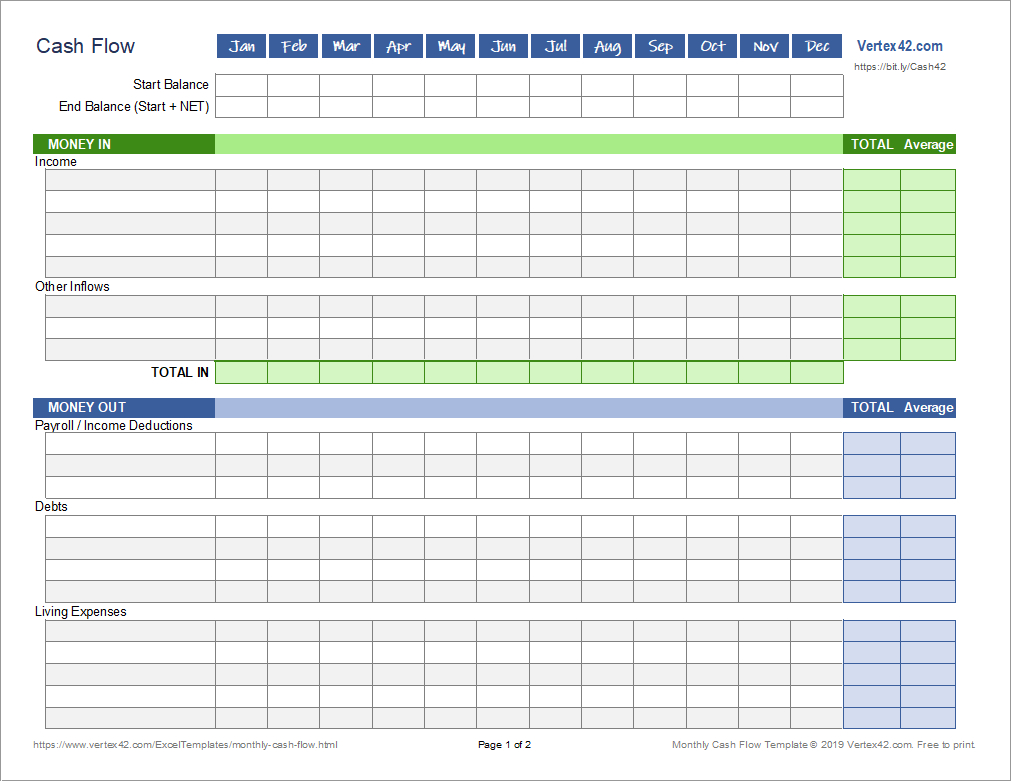

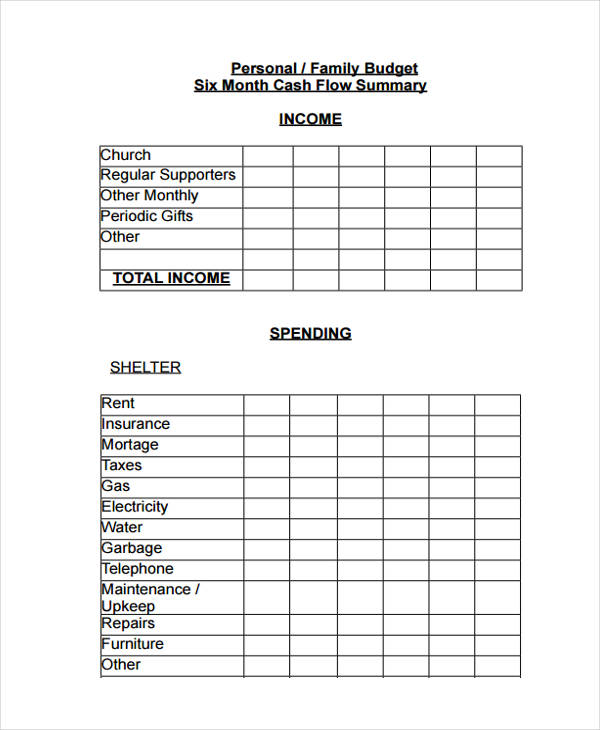

How this budgeting strategy started: Senator Elizabeth Warren founded the rule in her book, “ All Your Worth: The Ultimate Lifetime Money Plan.” (Buy it here on Amazon.) It’s a strategy designed to balance your needs and wants, while making sure you’re saving for a solid financial future.īasically, the 50 30 20 budgeting rule is the foundation for getting your financial life in order. I’ll break it down for you here and provide a 50 30 20 rule and spreadsheet. It’s perfect if you’re looking for an easy budget strategy or new to budgeting. Though a monthly budget is generally the most reasonable timeframe for which to set up an initial personal or household budget, there are many sources of income and expenses that do not perfectly follow a monthly schedule.The 50-30-20 budgeting rule is a simple plan to manage your money. You may even find that some months are different than others, but you should find through going through this exercise you are better prepared for those changes and even accounting for unanticipated personal expenses. As everyone’s financial situation is different, you may find that not every category is applicable to your income or spending. How to Use Your Free Personal Budget Templateīelow is a free excel monthly budget worksheet template for a personal budget that attempts to list possible sources of monthly income as well as expenses.

An accurate budget will also help you to answer that ever elusive question, “Can I afford it?” Though the word budget has taken on a more negative connotation over the years invoking an image of pinching pennies or limited spending, a budget is really just a tool-and a great tool at that-to gain better and more accurate insight into your spending habits.īy listing all of your sources of income against all of your monthly expenditures (from required expenses like mortgage or rent payments to discretionary spending like eating out or going to the movies), you get a true picture of your personal cash flow, which will allow you to make better and more informed financial decisions. A personal or household budget is an itemized list of expected income and expenses that helps you to plan for how your money will be spent or saved as well as track your actual spending habits.

0 kommentar(er)

0 kommentar(er)